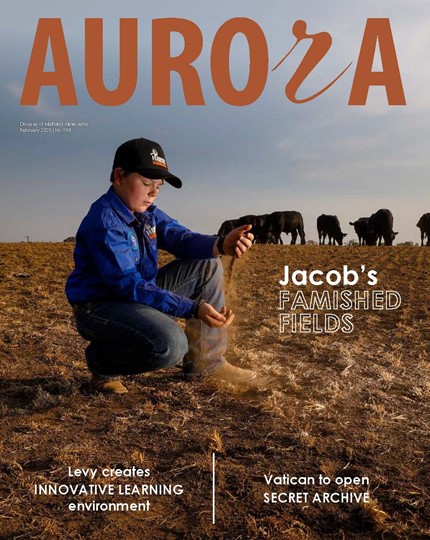

Rather, the prevailing sentiment dominating conversations is all about the rising cost of living.

So many people are feeling suffocated as they deal with this inflation and their shrinking household budgets.

Interest rates, food, energy and fuel prices, are just some of the everyday expenses that have risen dramatically.

Increased and prolonged financial pressure and accompanying stress can exacerbate pre-existing mental health conditions, as well as trigger new concerns, like depression and anxiety. Physical impacts of these stressors could include problems like hypertension (highblood pressure), and other inflammatory and stress-related conditions.

In short, the current cost-of-living crisis not only threatens to impact our wallets, but if not managed well, also has the capacity to harm our mental health, physical wellbeing, and ultimately, our ability to maintain functional and well-balanced relationships and family units.

Complicating the strain many people feel right now is the human desire to acquire material possessions or to provide goods or opportunities for family members, despite not necessarily having the financial means to do so.

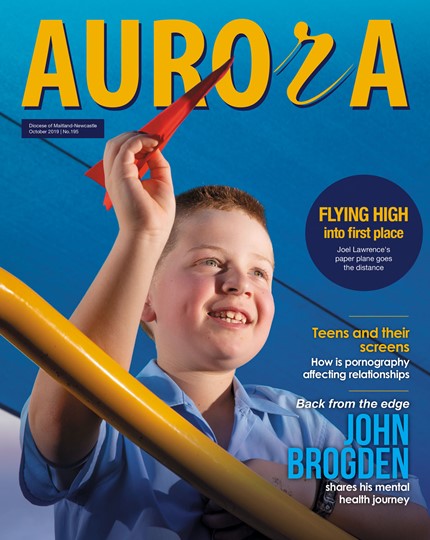

So, how do we take control of this firestorm, and ensure that we get to the other side in one piece?

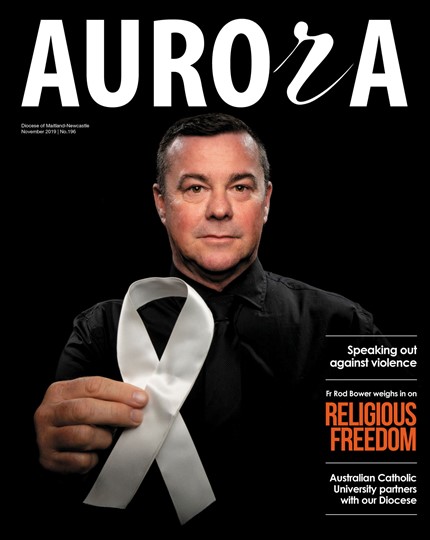

No matter what hurdles you may be facing in life, seeking help from a qualified mental health professional is always a positive step in managing challenges. A trained clinician has the necessary skills to help you navigate the “storm” in a caring and meaningful way. You do not have to face these challenges on your own. There is always help available.

Here are a few points to consider that will be useful in assisting our financial and mental fortitude:

- Be willing to not have it all. Our desires are endless, but they do not always correlate with the reality of our financial or mental wellbeing. Rather, decide on what your priorities are, and this process in itself will help determine what is necessary versus what we desire.

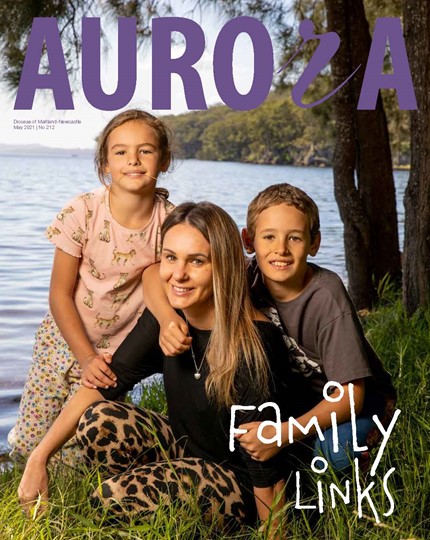

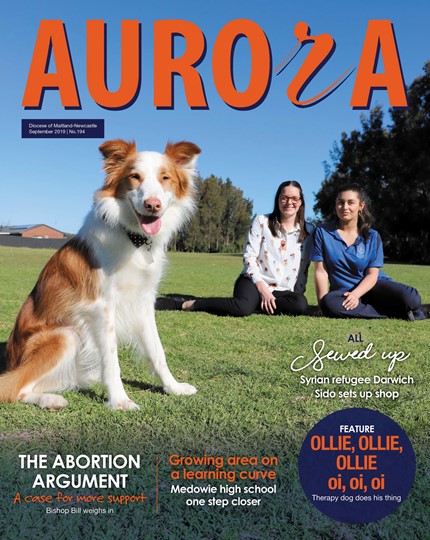

- Prioritise relationships above material goods. Investing in the quality of our relationships, improved communication, and pursuing the sense of community and belonging that we achieve when our relationships are strong is the perfect antidote to the desire to accumulate possessions. Moreover, the resulting sense of connection we are likely to feel will have a positive impact on our mental health as a result of the many feel-good hormones being released in our brains. The benefits to our well-being are endless.

- Practice gratitude. Practicing a sense of gratitude allows us to focus on what we have, as opposed to focusing on what we do not have. It is that same sense of gratitude that allows us to be present and living in the moment.

- Remember, it is human nature to feel anxious about things we can’t control and that are unpredictable and this can often lead to avoidance. Take action where you can – such as working on a budget as a family, where essentials are prioritised, and review together at regular intervals. This will assist in financial management as well as breaking big worries into smaller, more manageable bite-size chunks. Establish healthy routines, and avoid making unhelpful coping choices like excessive alcohol or gambling. These are short-term escapes and eventually make financial and stress-related problems much worse.

- Community support is available – there are options for free counselling, financial counselling services, as well as direct practical support such as food services. Don’t hesitate to seek the help that’s available to you, if it means it will help you get to the other side.

For more information on the Rosewood Centre visit rosewoodcentre.com.au or call 1800 613 155.

Follow mnnews.today on Facebook.